Today, copy trading is becoming increasingly popular. However, only a few people are well aware that the approach was created in 2005 when traders were seeking new automated ways to execute orders. They required new specific algorithms that permitted automated trading. Leading brokers, such as MTrading, and software developers quickly recognized the opportunity and pioneered copy trading as we know it today.

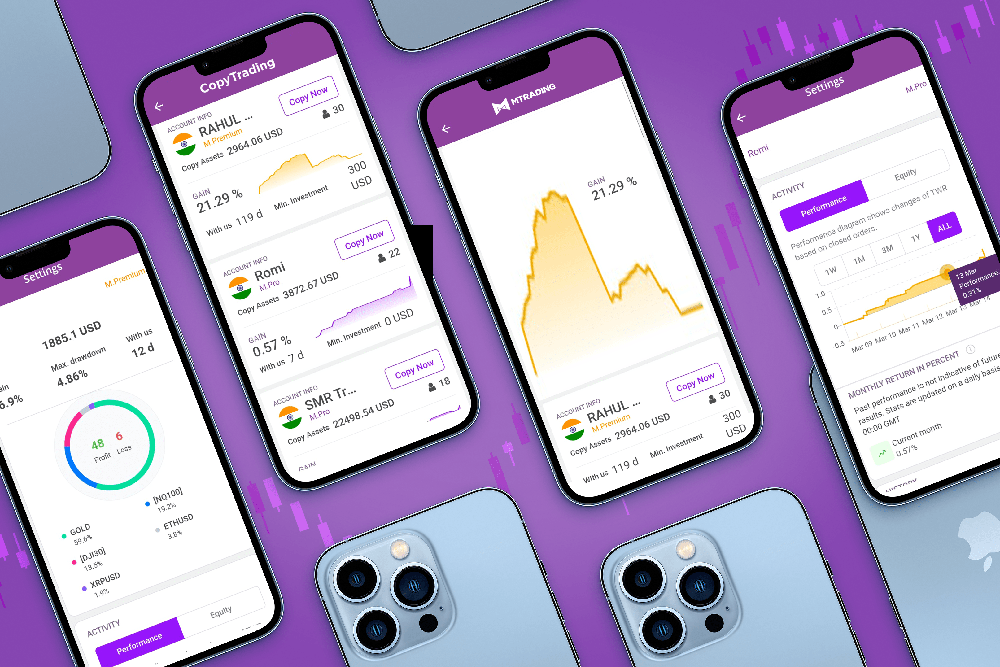

The concept of copy trading is straightforward. The strategy was designed for people with no prior experience, allowing them to follow more experienced investors and copy their trades across multiple markets. Since 2005, the concept has evolved. It now includes precise signal distribution, strategy customization, statistics tracking tools, and other tools to ensure safe and potentially profitable techniques.

It now includes precise signal distribution, strategy customization, statistics tracking tools, and other tools to ensure safe and potentially profitable techniques metatrader 4 for windows.

According to the most recent surveys and studies, copy trading is becoming increasingly popular due to the following statistics:

- Financial markets are too complex and difficult for 33% of all new stock traders. They believe that automated approaches will make copy trading a great way to start.

- In 2021, copy trading was practiced by 25% of traders.

- Copy-trading platforms have expanded by 96 % in the last year and have been expected to be worth €70 billion by 2025.

As you can see, the method appears to be pretty promising, especially in light of new algorithms, transparent tracking tools, and risk-management instruments that are already preloaded.

The method can be applied to a variety of financial markets. In other words, copy trading allows you to invest in a variety of assets depending on the strategy you prefer (either long-term or short-term trading). The following are the most popular markets:

- Cryptocurrency

- Stocks

- Indices

- Commodities

- Forex

Experts, on the other hand, recommend diversifying one’s portfolio, which involves investing in different assets that refer to various financial markets. Moreover, a little analysis can help you define the best time to enter or exit the market, while performance metrics and ratings will assist you in selecting a suitable trader to follow.